Two decades after the US launched a full-scale war to overthrow Saddam Hussein and remake Iraq in the image of a Western democracy, the Iraqi government just announced a new policy to finance all trade of Chinese goods in their currency, the RMB.

“It is the first time imports would be financed from China in yuan, as Iraqi imports from China have been financed in (US) dollars only,” the government’s economic adviser, Mudhir Salih, told Reuters on February 22nd.

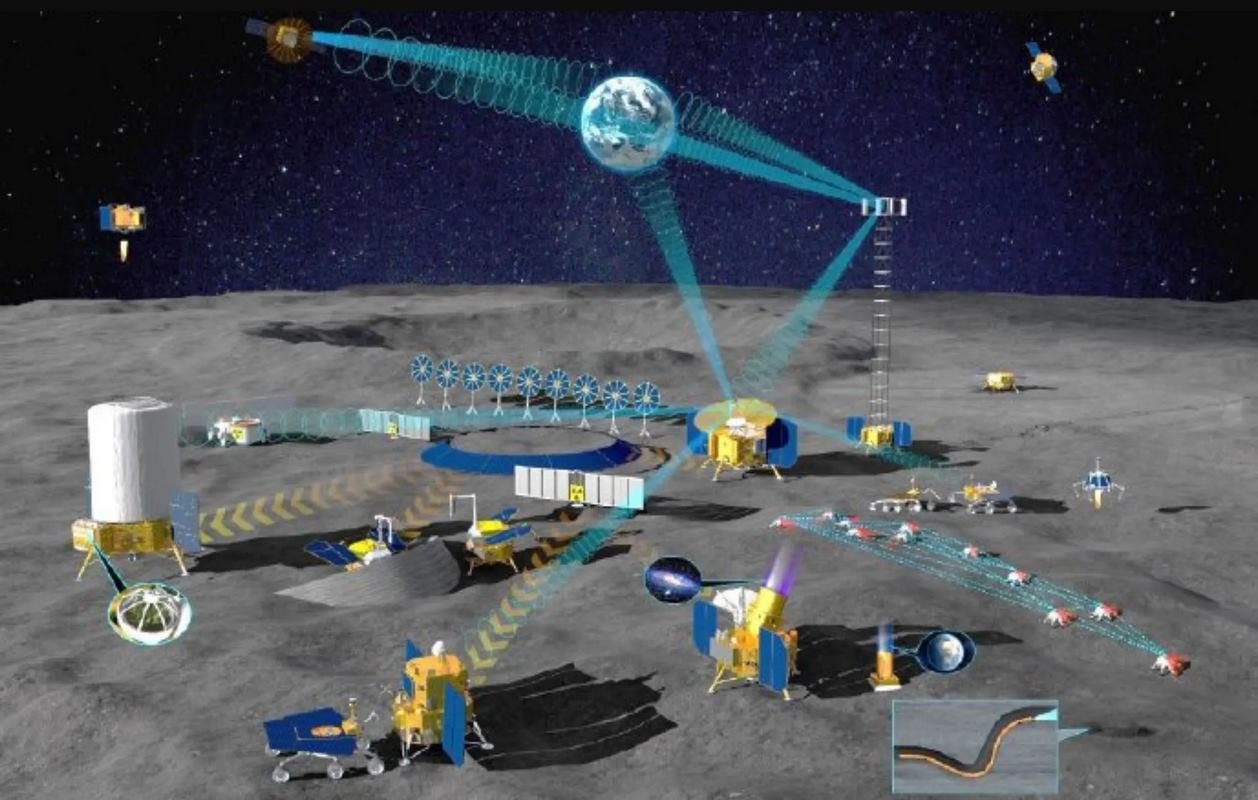

Iraq imports large amounts of electrical equipment and machinery from China. In 2022, Iraqi imports also included several nuclear power reactors as part of a plan to build a 37-gigawatt nuclear power sector. The value of all this trade has nearly doubled in the last decade, increasing from $6 billion to $10.5 billion.

For Iraqi banks that have open accounts with Chinese banks, the switch would boost foreign currency balances, shortages of which are a current economic concern in the country. However, it would depend on the size of existing RMB reserves held in Iraq’s central bank

The central bank is also considering converting US dollars held in their accounts with JP Morgan and the Development Bank of Singapore into RMB to finance this trade.

Another reason such a conversion would be beneficial is recent changes to finance laws and SWIFT compliance imposed by the US Treasury Department and Federal Reserve Bank of New York meant to “curtail money laundering and the illegal siphoning of dollars to Iran and other heavily sanctioned [West Asian] countries”.

However, those sudden changes meant that nearly 80% of average daily dollar wire transfers could not be completed.

Egypt, India, and other nations are trying to move sectors away from US dollar denomination. In the wake of the Ukraine war, the willingness of US financial planners to use the economic advantage of the dollar to enforce political doctrine has turned off many emerging markets in the Global South to the idea of relying on the dollar for international trade.

There’s no law that says the US dollar must be used for trade between countries, but the signing of the Bretton Woods Agreement meant that Saudi Arabia would only accept dollars for their oil, which coupled with the size of US financial markets and the power of their banking institutions, meant that the US dollar became a monopoly of convenience for the rest of the world.

If you think the stories you’ve just read were worth a few dollars, consider donating here to our modest $500-a-year administration costs.