As a slight rally in equity markets kicks off 2023, a stealth bull market in gold and silver continued into the new year. On Friday gold closed above $1,900 per ounce, the highest it had been since April. Silver closed at $24.14, a new 52-week high.

As the Federal Reserve (Fed) embarked on a tightening cycle that saw the fastest interest rate rise since the 80s to combat record-high price inflation, gold and silver slumped at the start of the year in response to lowering bond yields and a stronger US dollar.

Year-over-year price inflation continued to rise until mid-year however, leading to a reversal and a climb that currently hasn’t stopped.

A retrospective on asset classes published by Morningstar found that of 13 major asset classes commodities were king.

Noble Gold investments reports that gold held its value by the end of Q4, closing at down 0.15%, compared to a 21.47% fall in the S&P 500, and a 9.6% drop in the Dow Jones. Global equities were down 14.51%.

Other commodities such as copper, gained by year’s end, and commodities as a sector, thanks to gains in other areas such as energy, and agricultural products, rose 22%.

Bonds also performed badly.The Total Bond Index tracking US investment grade bonds lost 13%, while intermediate Treasury Bonds lost 10.6%, and the 30-Year Treasury Bond fell an astonishing 39.2%. In short, 2022 was a year in which the concept of US Treasury bills as defense assets were shattered.

“You’d have to go all the way back to the Napoleonic War era for the second-worst showing, when long bonds lost 19% in 1803,” said Edward McQuarrie, a professor emeritus at Santa Clara University who studies historical investment returns.

Going into 2023

The surprise re-opening of China has boosted most commodity stocks in early 2023, especially copper prices which have soared 9%, touching a seven-month high of $4.2 on January 13th.

Large copper miner index COPX has beaten the Nasdaq by 15% and the DOW by 10% since the start of the year, and several copper names have seen huge jumps. Southern Copper Corp (SCCO) has gained every day this month, rising more than 20%.

Silver investors believe that silver’s industrial side will bring the precious metal’s 52-week high price down about 16% to $21.00, but how the Fed determines to move forward with its interest rate hikes could raise demand to hold on its precious side.

For example, a report on silver by Investing News found that bar and coin demand—physical silver as a safe haven asset—rose 22% in 2022, citing the war in Ukraine, mistrust in government, and inflation worries.

“The rise was boosted further by a (near-doubling) of Indian demand, a recovery from a slump last year, with investors often taking advantage of lower rupee prices,” the Silver Institute and Metals Focus explain in their report.

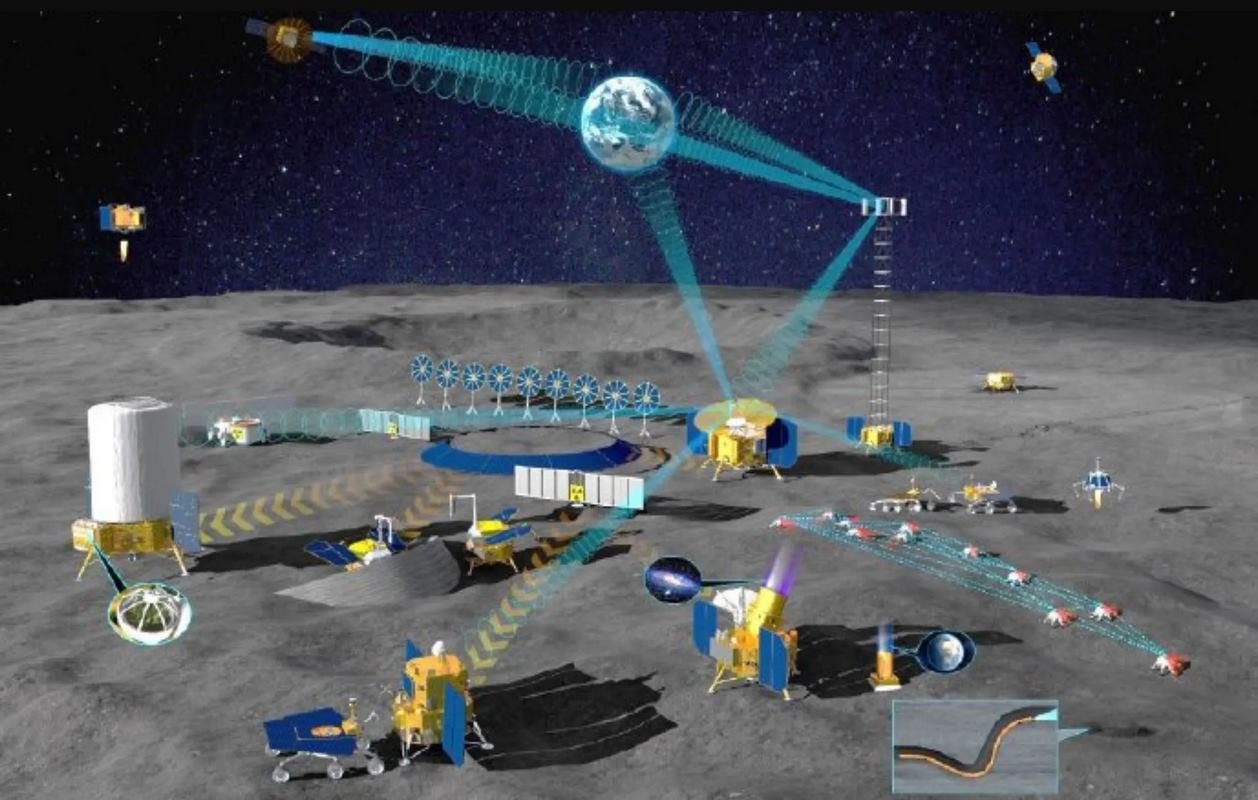

Gold is climbing for likely the same reasons. Gold doesn’t trade on its reputation as much as an industrial metal, despite being used in audio technology, electronic hardware, insulation, dentistry, jewelry, and aerospace.

After the worst year on record for the stock market since 2008, investors are hoping for a dovish turn from the Fed after 6 consecutive months of not-as-high-as-expected, year-over-year price inflation. Dropping from a year-over-year high to 9.1% in June to a milder, yet still unbelievable two years ago, 5.7% in December, there’s reason that the Fed might pivot towards lowering rather than raising interest rates to take advantage of the currently-strong labor market.

Investors have to take into account potential future increases in interest rates, i.e. the cost of borrowing, when deciding where to place their money, and with price inflation falling, stocks rallying for a spell, and strong labor market showings, the Fed may remain convinced they can raise interest rates without doing further damage to the economy.

Ironically, many investors, Marketwatch reports, are hoping for a recession in Q1 – Q2 that might force the Fed into abandoning their rate-hiking campaign and lower borrowing costs to support a failing economy.

These conditions make gold a continually attractive asset, as it has shown resilience in price level throughout Q3 and Q4 of 2022, when key price inflation reports continued to turn up rosy. Gold has risen in past recessions, and if investors expect one might be possible, gold could touch its price level from the beginning of the pandemic where it breached $2,150.

If you think the stories you’ve just read were worth a few dollars, consider donating here to our modest $500-a-year administration costs.