Geologists in China have now reported that they have identified two new large gold deposits inside the country that, if confirmed, would be the largest known to exist on Earth. South Africa’s South Deep Gold Mine of just under 1,000 tonnes has long been considered the world’s largest, but put together, the Chinese finds may be twice as large.

The first was found by Hunan province’s geological bureau, which reported that a super-large deposit of 1,000 tonnes or more was discovered using new 3D geological monitoring techniques. The second was found in the far-northern province of Liaoning, also believed to contain 1,000 tonnes or more of proven reserves, worth around $83 billion each.

China is already the world’s largest gold producer, commoditizing approximately 377 tonnes of gold ore annually, while the Shanghai Metals Exchange is the third-largest trader of non-ferrous metals in the world. However, South Africa has more proven gold reserves than China, at least before the recent discoveries in Hunan and Liaoning.

The deposit, though considered “low quality,” referring to the low ounces of gold per ton of material, was described as “easy-to-mine” because the material is uniform and simple to process. It stretches 1.8 miles east to west, and a little smaller north to south.

“Important progress has been made in prospecting, exploration, and deposit research,” the team that made the discovery said in a paper. adding that more than 430 tonnes of proven gold reserves had been found in Liaoning in recent years. The World Gold Council was muted about the discovery, describing it as “aspirational” rather than remarkable.

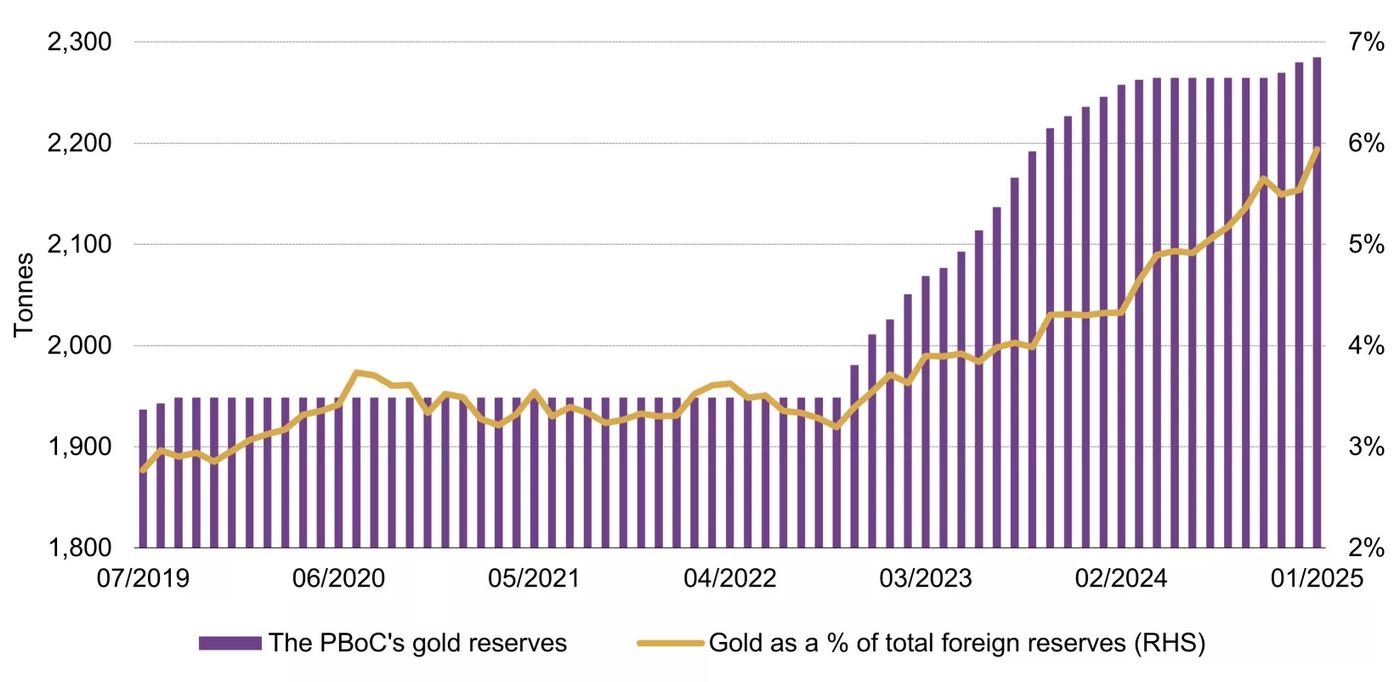

News of the Dadonggou gold reserve in Liaoning was published in China Mining Magazine in January, the same month in which the Chinese central bank (PBoC) bought approximately 5 tonnes of gold, taking the total percentage of foreign reserves represented by gold up to 5.9% of holdings.

Gold is a multi-faceted reserve asset, as it has demand through its role in electronics, jewelry, medicine, and aerospace manufacturing, as well as a hedge against the devaluation of fiat currencies like the RMB or the US dollar. January saw gold prices rise 7%, and as of publishing, the yellow metal has reached new all-time record highs of $3,095 per ounce.

China announced a total of 44 tonnes in gold purchases during 2024 despite a much-publicized six-month pause in the middle of the year. However, the true total could be much higher. Between 2022 and November of 2024, Money Metal’s Jan Nieuwenhuijs writes that China had bought around 600 tonnes from the London Gold Exchange without reporting it to the IMF or anybody else. Goldman Sachs later put together its own report on the subject using his research.

Because Chinese and British customs report these things faster than financial institutions, and because several large purchases of gold were carried out in Beijing at times when the Shanghai Gold Exchange was charging very little in premiums for selling gold due to lower prices and lower demand, Nieuwenhuijs concludes it must be the PBoC and not private buyers. WaL

We Humbly Ask For Your Support—Follow the link here to see all the ways, monetary and non-monetary.

PICTURED ABOVE: Technicians of Hunan Province Geological Disaster Survey and Monitoring Institute check rock samples at the Wangu gold field in Pingjiang County, Central China’s Hunan Province. PC: Xinhua / Su Xiaozhou