End of the Empire is a once-monthly feature on all news relating to the transition from the unipolar world of the US Empire to a multipolar world.

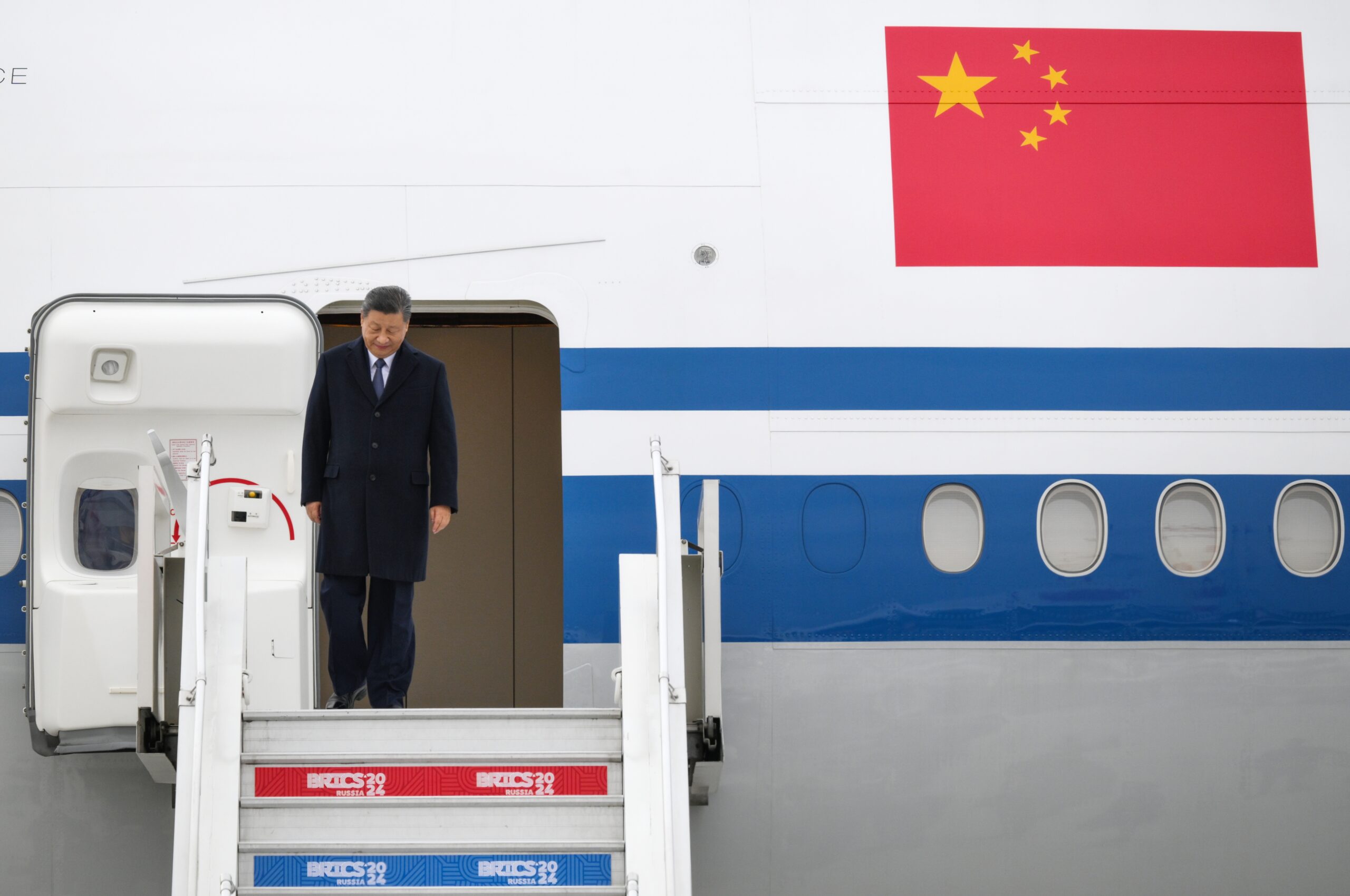

The 16th annual BRICS Summit has kicked off in Kazan, Russia. It is the largest gathering of foreign heads of state in Russia in decades, and a show of clout that beyond the reach of Western sanctions, Russia has many partners with which it can collaborate.

The agenda features many different conferences, but the news much of the world will be waiting to hear is whether the group of nine nations will try and launch a new reserve currency, and which other nations will be invited to formally become a part of BRICS.

This year, several high-level ministers and diplomats from prospective countries will be attending, despite the attempts to isolate Russia from the world economy, and the arrest warrant issued by the ICC for Vladimir Putin for war crimes. This year’s conference is the first that Ethiopia, Egypt, UAE, and Iran have attended as full BRICS members.

BRICS was always a diverse bunch, and the newly expanded version of the trading bloc-cum-development group designated “BRICS+” is stranger still. It includes, as always, the world’s largest Marxist-Leninist state, the world’s largest democracy, the nation that defeated apartheid, and arguably the largest dictatorship in the world. BRICS+ sees added to that club nations under the US security umbrella, another that’s under US sanctions, and a regime installed and propped up by the United States.

If you look inside the pot at who’s attending this year’s BRICS summit in Kazan, the stew becomes even funkier—one of Washington’s South American neighbors and one of her NATO allies as well.

One of the key themes of this column is the coverage of foreign and commercial policies from nations around the world that stress the word “multipolarity,” a deliberate choice of vocabulary to denote opposition to the United States’ unilateral world order. While the mixture of voices and powers in BRICS+ is indeed diverse, the message is not: the world needs an alternative to the Western world’s institutions.

Keith Johnson, writing at Foreign Policy, puts it succinctly.

“Outside of Washington, the G-7, and the European Union, it is hard to appreciate just how much resentment there is of Western hypocrisy and hegemony, all mortar helping to bond the loose membership of BRICS. That has become especially evident over issues such as the conflict in the Middle East, the hyperweaponization of US sanctions, and the outsized cost for middle-income countries of the dollar’s exorbitant privilege”.

The problem

At last year’s summit in Johannesburg, BRICS announced as official policy that one of the chief objectives of their bloc is to up-end the US dollar’s dominance in global trade and finance. To make a long story short, for all of human history, ease of use and convenience have been powerful drivers in selecting a currency for trading internationally.

The US dollar accounts for over 80% of settlements between trading partners worldwide, even if neither of the trading partners is the US. This incredibly outsized influence in how the world trades has allowed successive US regimes and central bank governors to bring down everything from headaches to financial paralysis on virtually any country at any time.

Because dollars are needed to trade internationally, US banks are involved in nearly all global transactions, giving them insight into the economic activity of the world never seen before by a single world power. Entities sanctioned by the Treasury Department’s Office of Foreign Asset Control are quickly identified as they attempt to move monehy, and are blocked from doing so. Private entities attempting to do the same can be liable to violating sanctions and thus to massive financial penalties. For countries that rely on export markets for their commodities, manipulation of the national interest rates on the dollar can suddenly make credit lines too expensive, existing debt unfinanceable, and push once-black bottom lines in the red.

For governments, it’s often no easier as the outsized influence of the dollar is felt through the two major international lending institutions the World Bank and International Monetary Fund. The US is a board member of the World Bank and holds a veto on its lending decisions.

All this has pushed the Global South, members of the Non-Aligned Movement, and sanctioned entities like Iran to want something, anything, to replace this unilateral monetary system.

The problem for BRICS+ is that the dollar is the cleanest dirty shirt in the laundry, and as Johnson writes, try telling India, which is occasionally engaged in violent border disputes with China, that the renminbi is going to be the new world’s reserve currency.

The solution

Following the conclusion of the St. Petersburg International Economic Forum and the June meeting of the BRICS foreign ministers, a white paper was issued detailing how BRICS would approach its long-awaited shot at creating an international trading currency backed by gold.

The world economy hasn’t been linked to gold for over 50 years, and attempting to reattach today’s hyperinflated fiat currencies to a hard asset like gold is as likely to destroy the economy of any of the BRICS+ members as it is to destroy the dominance of the dollar. WaL has reported before that BRICS nations have been extensively buying gold for several years now.

It could be, since the white paper was issued in June, that something will come up regarding the “UNIT”—the working name for the trading currency—at the summit in Kazan which will run until the 24th. The UNIT, according to the white paper, would be a digital asset settled on a blockchain ledger—the same as Bitcoin, but with a value equal to 40% gold, and 60% participating BRICS currencies valued against gold.

The UNITs would be created when a consumer or entity visits a physical UNIT node, perhaps the BRICS-run New Development Bank, and deposits on reserve 40% of the value of their desired UNIT quantity in grams of gold, and 60% of a BRICS currency priced in gold. For example, if an Indian investor wanted one UNIT, he or she would visit the local UNIT node, and deposit 0.4 grams of gold, and 4,407 rupees—the price of 0.6 grams of gold at the spot value from the time of writing.

The UNIT would not be designed to take the place of local currency usage, but rather to offer an alternative to trading internationally that would bypass existing US finance infrastructure, such as the SWIFT international settlement system, and restore buying and selling power to nations and individuals who don’t want to use dollars.

This would happen in part because of some basic rules of monetary economics. Money gets its value from several necessary jobs it must do, and from the value it has in the minds of potential users who need to use money. Dollars, though just pieces of paper, have a tremendous use value because of all the different goods and services you can buy with them. The national currency of Nicaragua, to use one example, has very little use value beyond the borders of Nicaragua.

The UNIT as the white paper describes it would allow users to access markets where their national currency isn’t as valued because part of the UNIT is denominated in gold. A Frenchman, for example, could take the UNIT, having little need for the value of the Rupees contained therein, because the 0.4 grams of gold can be used for settlement in other currencies (like the euro).

The dollar buys 40% less gold now than it did just two years ago, meaning that the gold contained in the UNIT protects it from monetary manipulation in Washington. If participating BRICS+ countries need to trade in dollars, dumping their UNITS yields a 40% return measured by the price of gold, which buys 40% more dollars now than two years ago.

At the moment, no mention of the UNIT has been made at Kazan. The introduction of it could be a world-changing event.

We Humbly Ask For Your Support—Follow the link here to see all the ways, monetary and non-monetary.

PICTURED ABOVE: Russian President Vladimir Putin meets with Indian Prime Minister Narendra Modi during the 16th BRICS Summit in Kazan. PC: Kristina Kormilitsyna, Photohost agency brics-russia2024.ru