News broke last week that upon reaching a new all-time record high of over $2,500 per troy ounce, the standard gold bar is now worth $1 million. The price has enjoyed several sharp moves up in recent months, and while some traders may have been fooled by brief pullbacks, $2,300 seems to be strong resistance, and no ceiling has yet been established.

Gold is many things to many people, spanning the range of opinions between a “barbarous relic” and the secret to a stable monetary system. Gold as an investment has enjoyed a bull market for about 10 months since it began rising from its recent 52-week low in September of 2023 at $1,850 an ounce.

Several factors have propelled gold’s recent rise. In general, geopolitical tensions tend to increase the demand for safe-haven assets—however each investor chooses to define them. The military exchanges between Israel and Lebanon, and the threat that Iran might attack Israel in some way over the assassination of a Hamas political leader while visiting Tehran, along with Ukraine’s incursion into Russian territory, increased geopolitical tensions without a doubt.

Another reason may be the sticky price inflation that, despite over a year of the Federal Reserve holding interest rates at 4% or higher, hasn’t fallen to 2%. Indications have been made by Fed Chairman Jerome Powell that rates may be coming down, which some investors may see as signaling higher price inflation to come. Powell has previously said that the purpose of interest rates is to reduce borrowing, which hasn’t happened across the whole of the US economy, and the return to lower rates would signal a return to easier credit which caused the price inflation in the first place.

Another reason has been substantial buying from central banks around the world putting pressure on the price of gold. China led that push, increasing its gold reserves by 224.9 tonnes over the last 12 months, during which the price gradually increased by 30% against the US dollar.

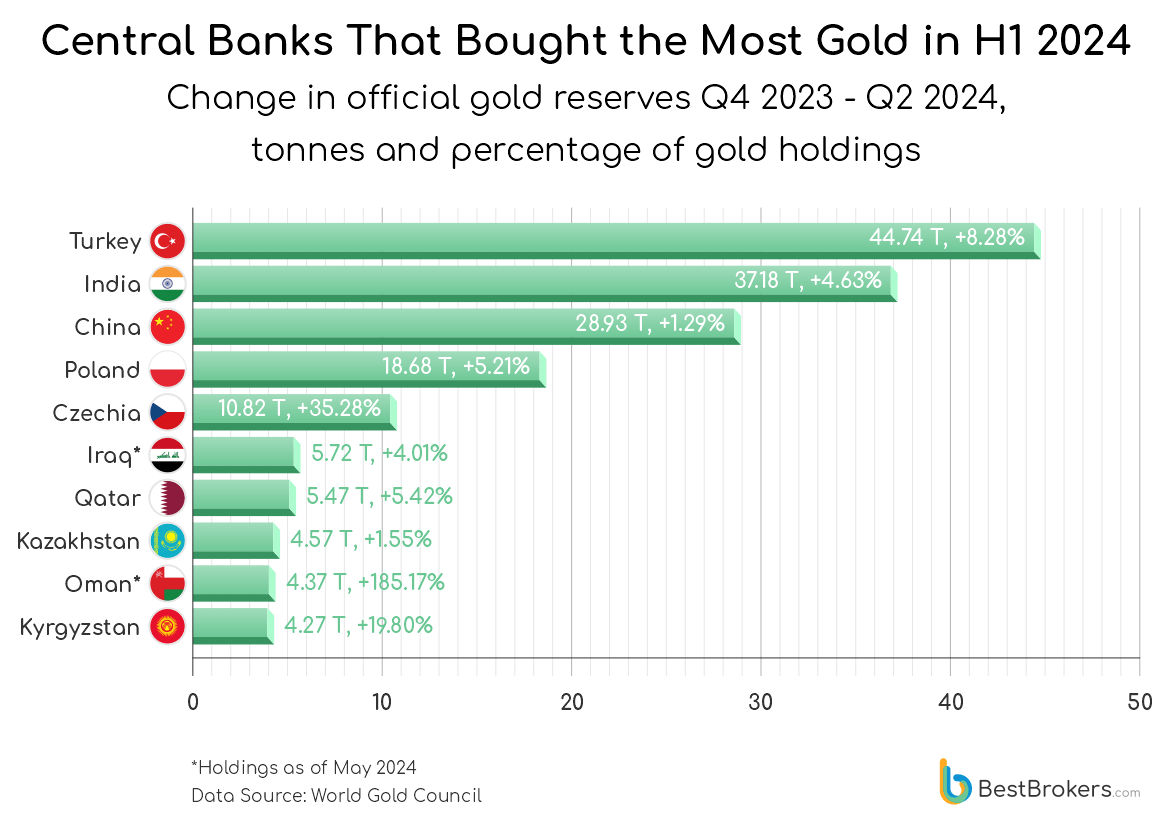

“During the first half of 2024, China’s central bank acquired a total of 28.93 tonnes of gold, putting it third in terms of gold demand after Turkey and India,” writes Paul Hoffman at Best Brokers, a rating agency for brokerage houses. “The most significant increase in gold reserves between January and June of this year can be seen in Turkey. The country’s central bank bought a total of 44.74 tonnes during the first half of the year, with June being the 13th month in a row of buying”.

India, Hoffman writes, is also building its gold reserves at a healthy clip adding 37.18 tonnes within the first six months of 2024. Poland also spent 2023 on a buying spree, adding 130 tonnes of gold.

Gold miners yet to catch up to the price

Strangely, this dramatic 5-month rise in the price of gold hasn’t been reflected in the shares of gold mining companies. Between January and March of this year, as the price of gold hovered at just over $2,000 an ounce, Newmont Mining (NM), the largest gold mining firm on the planet by market cap, reached a new 52-week low of $29.42. It closed yesterday at a price of $52.70 at a new 52-week high.

It traded for that same price in April of 2023 when the gold price was over $500 less than it is now. An almost identical pattern can be seen in another large gold miner, Barrick (GOLD) which made a new 52-week high last week. From another perspective, the GDX gold miners index never reached the highs of April-May 2023, and is only just now reaching the price areas the stocks within (including both GOLD and NM) are reaching.

A trader would expect the companies producing the material that has increased 65% in value over the last three years to see commensurate increases, but the stocks haven’t adjusted to the new price of gold.

GOLD traded, for a historical example, at 29.45 in January of 2007, just before one of the most dramatic moves up in the price of gold in history. It traded as high as $54.00 in 2008, and made that high again in 2010, as a result of the rise in gold prices. For the two decades prior, central banks worldwide were net sellers of gold, driving the price down. At the onset of the 2007-2008 Financial Crisis, central banks began buying gold again.

At the moment, central banks have been buying for years, and the long-expected leap up in the price of gold seen this year is a delayed result of many years of buying which is likely to continue.

There should still be substantial upside in gold mining stocks, but traders and investors either haven’t seen that reflected in earnings (although GOLD has beat expectations 8 quarters in a row) or are simply not interested. WaL

We Humbly Ask For Your Support—Follow the link here to see all the ways, monetary and non-monetary.

PICTURED ABOVE: Pan Jingming, Unsplash